Why do you need to

plan school fees

There are many reasons why you should take expert advice when planning your school fees payments. Not only can specialist advice offer peace of mind, but it could also help to save you a lot of money in the long term.

Currently, eighty per cent of parents pay school fees directly from their income. Whether the fees are readily affordable or not, this is likely to be the least efficient method of payment. Whatever your circumstances, the cost of school fees can be significantly reduced.

Good planning is effective at any point, but the earlier you start, the greater the potential for savings

A school fees plan will help:

- Understand when resources will be most stretched and make contingency for this

- Make the fees more affordable

- Maximise your wealth

- Ensure continuous education for your children

- Minimise taxation (where appropriate)

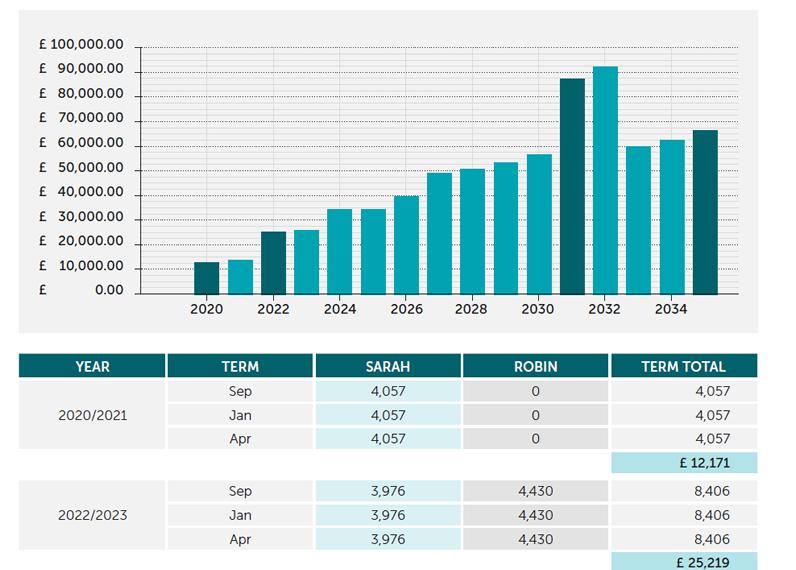

School fees profile

We have tools that will forecast your future school fees and associated costs. A school fees profile by term will illustrate the problem at hand, highlighting the peak periods.

Making the fees more affordable

Although paying for one child’s education can be well within a family’s means, the difficulty often arises when it comes to paying fees for several children. Overlapping years can place stress on household budgets and increase worry, but this can be averted by using effective strategies to forecast and manage the tough times ahead.

Spreading the cost of school fees over a longer period is one strategy to make private education more affordable and we have solutions to achieve this. Suitable investment and tax planning will also help affordability and increase your wealth in the long term.

Maximising your wealth

By combining certain strategies, it is possible to achieve a common goal. The key is to take advantage of the most appropriate investments and savings and combine these with efficient tax planning at a time that is right. This can bring about significant benefits that contribute to boosting your family’s overall finances. Our aim is to keep your standard of living as high as possible throughout private education and beyond.

Ensuring continuous education for your children

Having decided to educate your children independently, it is important to take appropriate advice to ensure the continuity of their education.

Otherwise, if the cost of education becomes too great, there may be no other option but to remove your son or daughter from private education. However, such a decision can be avoided through a combination of forward-planning and seeking expert advice. The plans we put in place help ensure that your child can not only remain in independent education, but also enjoy its continuous benefits and be able to leave school with an impressive academic record.

There are products available that protect school fees payment in the event of redundancy, unemployment or accident and sickness

Minimising taxation (where appropriate)

Most families pay for school fees using income that has been taxed or assets which are taxed when released.

In certain scenarios, we are able to mitigate or reclaim some of this tax through personalised planning strategies which in turn helps create a significantly improved situation.

We have proven strategies that relate to income, capital gains and Inheritance Tax; the proceeds of which can be put into your school fees plan.

At SFIA, we offer a vast array of tax solutions, both ready-made and bespoke.

For those that qualify, our Pension Plan is often one of the best options.

It is possible – without any extra monthly cost – to build up a substantially greater pension fund and pay off your school fees. The additional tax relief gained can often be more than the original school fees!